I’m not easily excited but this fuel cell company is making some big strides.

This has been an interesting year for the renewable energy sector and the associated technologies that are arising around it such as battery storage, energy efficiency programmes and smart grids. Ceres Power is one very exciting company that are making major innovations in a staid industry.

If you’re tired of bland and boring investment opportunities that seem bereft of passion or innovation they are certainly worth a look. While the company is not a renewable energy generator it’s role in helping to reduce emissions should be lauded. Ceres is a fuel cell maker based in Horsham in West Sussex, and is a company that started life in the minds of a Professor at Imperial College London, the suitably named Brian Steele.

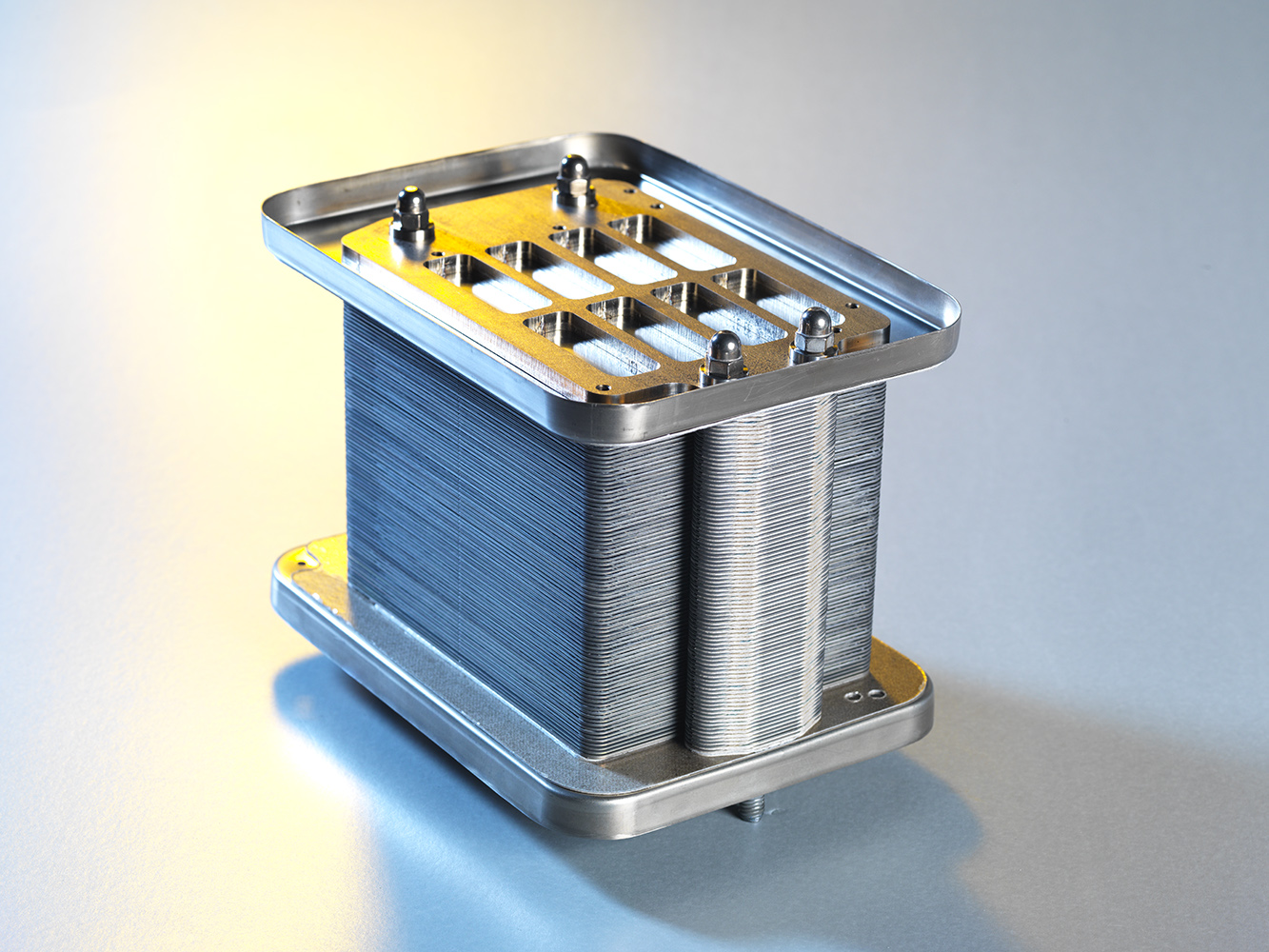

Its key technology is the SteelCell, which as the name suggests is not a precious metal derived piece of kit but made of steel. The fuel cell market is huge in Japan, but in the UK is somewhat of a growth industry. Fuel cells work by taking a fuel source (natural gas/biofuels or hydrogen in the case of the SteelCell) and converting them to electricity.

The SteelCell is intended for both domestic and business customers, with the idea being that the energy efficiencies produce reductions in energy spending and carbon equivalent emissions.

Recent work highlighted by the company include data centres, trials with British Gas for domestic usage and a programme with Nissan to help extend the range of electric vehicles and hence cut refuelling times.

In September Ceres noted that it had completed a trial as part of an EU led programme. The company said that UK homes can expect savings of around £400 per year.

Ceres offers an interesting part of the energy matrix if the issues around rising demand driven by the uptake in electric cars is considered. There has been much discussion on how the grid will cope with the extra millions of new electric car drivers and technology such as the SteelCell will be essential to deal with the potential strain on the grid.

In the domestic market its edge is in providing energy savings to consumers through providing electricity to the home from the natural gas grid. In the commercial market data centres look of particular interest.

On results for the year to June 2017 Ceres reported a loss of £11.5 million on turnover of £3 million.

Ceres Power and its SteelCell are part of the technology mix that is necessary as we move to a new epoch in human history. Smart meters, electric cars, renewable energy generation and fuel cells all have synergies needed to help the other technologies thrive.

Electric cars provide incredible advantages to the environment and also to consumers but require technological innovations in storage and handling the demand on the grid, as well as more prosaic innovations in cabling and parking.

Ceres Power is an important part of the mix and their partnerships with a number of significant players is commendable.

Given the abundance of questionable investments in the small cap space, Ceres Power is one company that should draw the attention of a wide range of investors, from the technology focused to the risk averse willing to take a punt but who wish to steer clear of some of the flightier opportunities in the sector.

Note: Neither the author nor any of the members of the Renewables Investor staff have received any payments from Ceres Power or associated companies. The above does not constitute financial advice and those seeking out financial advice should seek out the services of an Independent Financial Adviser.

Be the first to comment on "Why Ceres Power excites me"